Semiconductors are the key enabling technology in a broad range of products across virtually all segments of our economy. Despite a cyclical market downturn that took hold during the second half of 2022, global semiconductor sales reached an all-time high of $574 billion for the year, an increase of 3.3% over 2021 sales. Newly released data on 2022 semiconductor sales by broad product category, known as “end use,” reveal which types of products saw the largest sales increases in 2022.

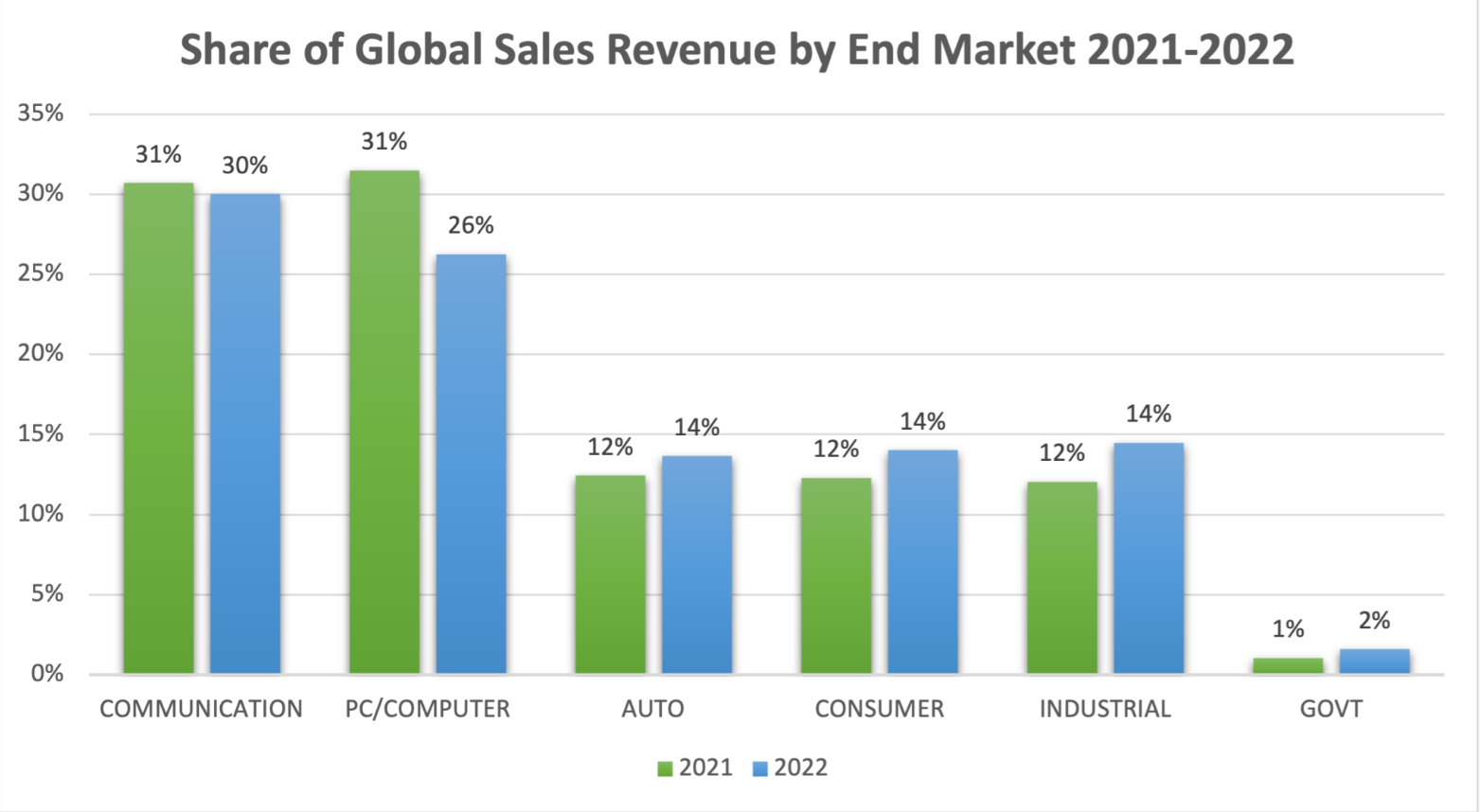

Historically, the PC/computer and communication end markets have accounted for approximately two-thirds of overall sales, with sectors such as automotive, industrial, and consumer electronics accounting for the remainder. But sales by end-market in 2022 showed a marked shift, according the 2022 Semiconductor End-Use Survey from the World Semiconductor Trade Statistics (WSTS) organization. While the PC/computer and communication end markets still accounted for the largest share of semiconductor sales in 2022, their lead shrunk. Meanwhile, the automotive and industrial applications experienced the largest growth for the year.

The table below presents the change in market share.

Source: WSTS and SIA analysis

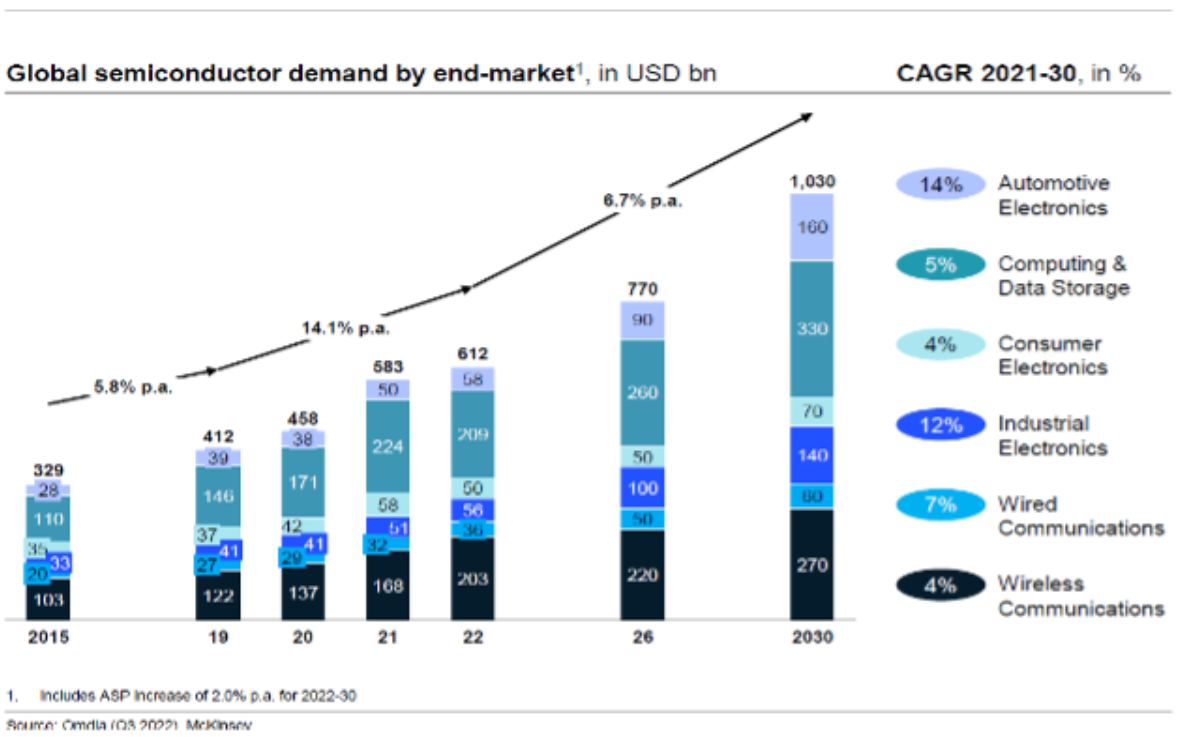

Illustrating the growing demand for chips in these industries, the automotive and industrial sectors will represent 14% and 12% of the average growth in chip sales by 2030, respectively, driving demand growth through the decade, according to a McKinsey analysis (see table below). Despite the current short-term downturn in the global semiconductor market, demand for chips in the long-term is expected to show vibrant growth. And, to meet this growing demand, our industry has recently committed to expanding manufacturing capacity in the U.S. through private investments of over $200 billion thus far.

Note: Per Annum (p.a.)

Source: SIA

최신 산업 동향을 받아보려면 구독하세요.저희 뉴스레터는 전문가가 제공드리는 가치있는 시장 정보입니다.

The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increa

In 2025, we expect 9.5% growth in the global semiconductor market, driven by robust demand for data centre services, including AI. However, growth in other, more mature segments is expected to be stag

Taiwanese chip manufacturer TSMC has announced a $100 billion investment in the United States, aiming to build five additional semiconductor facilities.The plan was revealed by TSMC CEO C.C. Wei along

Prices of mature process memory, long hit by oversupply due to fast capacity expansion at Chinese makers, are expected to rebound, thanks to the Chinese government's consumption stimulus programs.

With the ongoing development of new-generation processors, the introduction of PCIe Gen5 specifications into high-end PC applications is set to commence in 2025. According to Micron Technology, Gen4 p

The global market is watching how TSMC, pressured by the US, might assist Intel's foundry operations, while Samsung Electronics and Rapidus, also facing challenges, may similarly require TSMC'