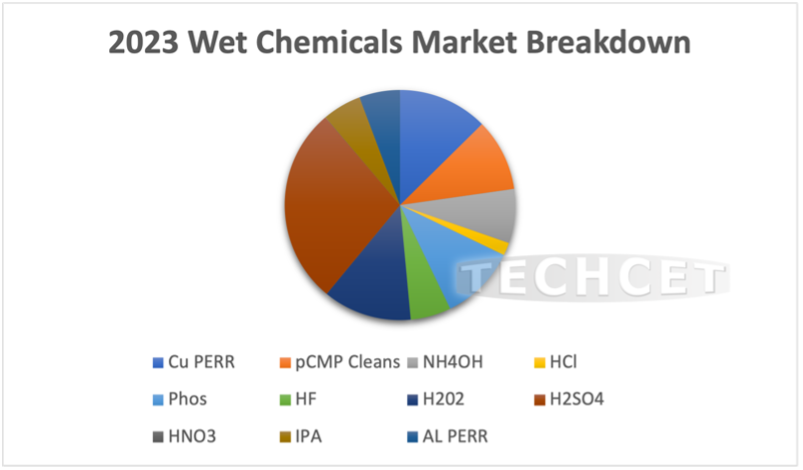

TECHCET— the electronic materials advisory firm providing business and technology information on semiconductor supply chains — is forecasting the Semiconductor Wet Chemicals market to slow to -0.9% in growth in 2023, as noted in the most recent update to TECHCET’s Wet Chemicals Critical Materials Report? . This slowdown is following downward trends for the overall global economy as risks of recession and rising inflation continue. Through 2023, the semiconductor materials market is expected to be flat, though positive growth could be seen if average selling prices from last year’s demand hold over to this year. By 2H2023, TECHCET is anticipating growth to return, leaving a forecasted 6.4% 5-Year CAGR from 2022-2027.

TECHCET is estimating wafers starts to also decline by about 5% in 2023. Between 2022 and 2023, NAND flash makers are rolling out approximately 200+ layer chips offerings. Into 2026 and 2027, 4XXL and 5 XXL 3DNAND are also expected to surge.

DRAM is currently undergoing a transition to EUV and full implementation of High-k/Metal Gate. Architectural changes and new patterning technology has also driven the need for new unit processes and new materials. With each such change, there is a growing need for more Chemicals and Wet Clean processes.

Several new material expansions have been announced between the US and Korea that should affect the Wet Chemicals market in the coming future. For example, LCY Group based in Taiwan, who is a key supplier to TMSC, has publicly announced an IPA repackaging and purification in Phoenix. Additionally, Chang Chun Group’s $400M investment towards a H2O2, TMAH, and plating solution facility in Arizona is expected to conclude their phase 1 soon.

sources:semiconductor digest

최신 산업 동향을 받아보려면 구독하세요.저희 뉴스레터는 전문가가 제공드리는 가치있는 시장 정보입니다.

The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increa

In 2025, we expect 9.5% growth in the global semiconductor market, driven by robust demand for data centre services, including AI. However, growth in other, more mature segments is expected to be stag

Taiwanese chip manufacturer TSMC has announced a $100 billion investment in the United States, aiming to build five additional semiconductor facilities.The plan was revealed by TSMC CEO C.C. Wei along

Prices of mature process memory, long hit by oversupply due to fast capacity expansion at Chinese makers, are expected to rebound, thanks to the Chinese government's consumption stimulus programs.

With the ongoing development of new-generation processors, the introduction of PCIe Gen5 specifications into high-end PC applications is set to commence in 2025. According to Micron Technology, Gen4 p

The global market is watching how TSMC, pressured by the US, might assist Intel's foundry operations, while Samsung Electronics and Rapidus, also facing challenges, may similarly require TSMC'