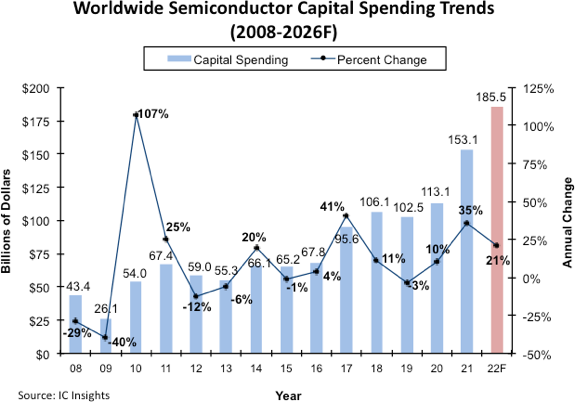

According to the latest data released by IC Insights, a leading semiconductor analyst firm, shows that the three years from 2020-2022 will be the first three-year period since 1993-1995 when capital expenditures achieved double-digit growth.

IC Insights adjusted its 2022 global semiconductor capital expenditure forecast, which now shows a 21 percent increase this year to $185.5 billion, as follows:

This is a decrease from the $190.4 billion and 24% growth forecast earlier this year. Despite the downward revision, the revised capex forecast still represents a new high level of spending.

Utilization rates remain well above 90% for many IDM plants and 100% for many pure-play foundries in the first half of the year, as the economic recovery during the epidemic kept orders strong.

Semiconductor capital spending is now expected to reach $338.6 billion for the two years combined in 2021 and 2022. IDMs and foundries are investing heavily in expansions for the manufacture of logic and storage devices using leading-edge process technologies. However, strong demand and continued shortages of many other important chips, such as power semiconductors, analog ICs and various MCUs, have led suppliers to increase manufacturing capacity for these products as well.

Despite all of this positive news, soaring inflation and a rapidly slowing global economy caused semiconductor manufacturers to reassess their aggressive expansion plans mid-year. Several (but not all) suppliers, particularly many of the leading DRAM and flash memory manufacturers, have already announced cuts to their capital expenditure budgets for the year. More suppliers are noting that they expect to cut capex in 2023 if they assess capacity needs based on the industry absorbing three years of strong spending and slowing economic growth.

source:aijiwei

최신 산업 동향을 받아보려면 구독하세요.저희 뉴스레터는 전문가가 제공드리는 가치있는 시장 정보입니다.

The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increa

In 2025, we expect 9.5% growth in the global semiconductor market, driven by robust demand for data centre services, including AI. However, growth in other, more mature segments is expected to be stag

Taiwanese chip manufacturer TSMC has announced a $100 billion investment in the United States, aiming to build five additional semiconductor facilities.The plan was revealed by TSMC CEO C.C. Wei along

Prices of mature process memory, long hit by oversupply due to fast capacity expansion at Chinese makers, are expected to rebound, thanks to the Chinese government's consumption stimulus programs.

With the ongoing development of new-generation processors, the introduction of PCIe Gen5 specifications into high-end PC applications is set to commence in 2025. According to Micron Technology, Gen4 p

The global market is watching how TSMC, pressured by the US, might assist Intel's foundry operations, while Samsung Electronics and Rapidus, also facing challenges, may similarly require TSMC'