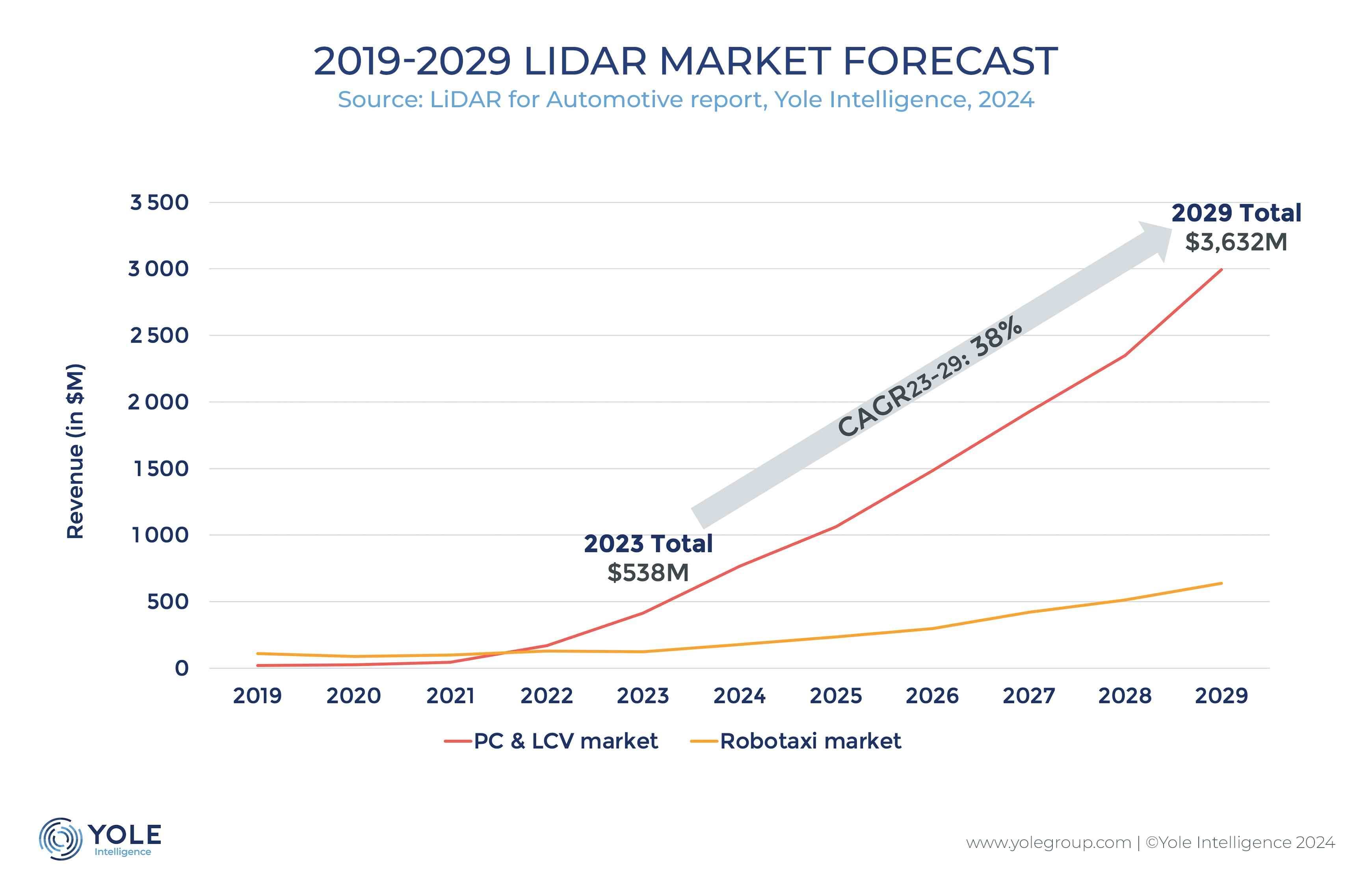

The global LiDAR market for automotive is expected to grow from $538 million in 2023 to $3,632 million in 2029 at a 38% CAGR 23-29, says Yole Group.

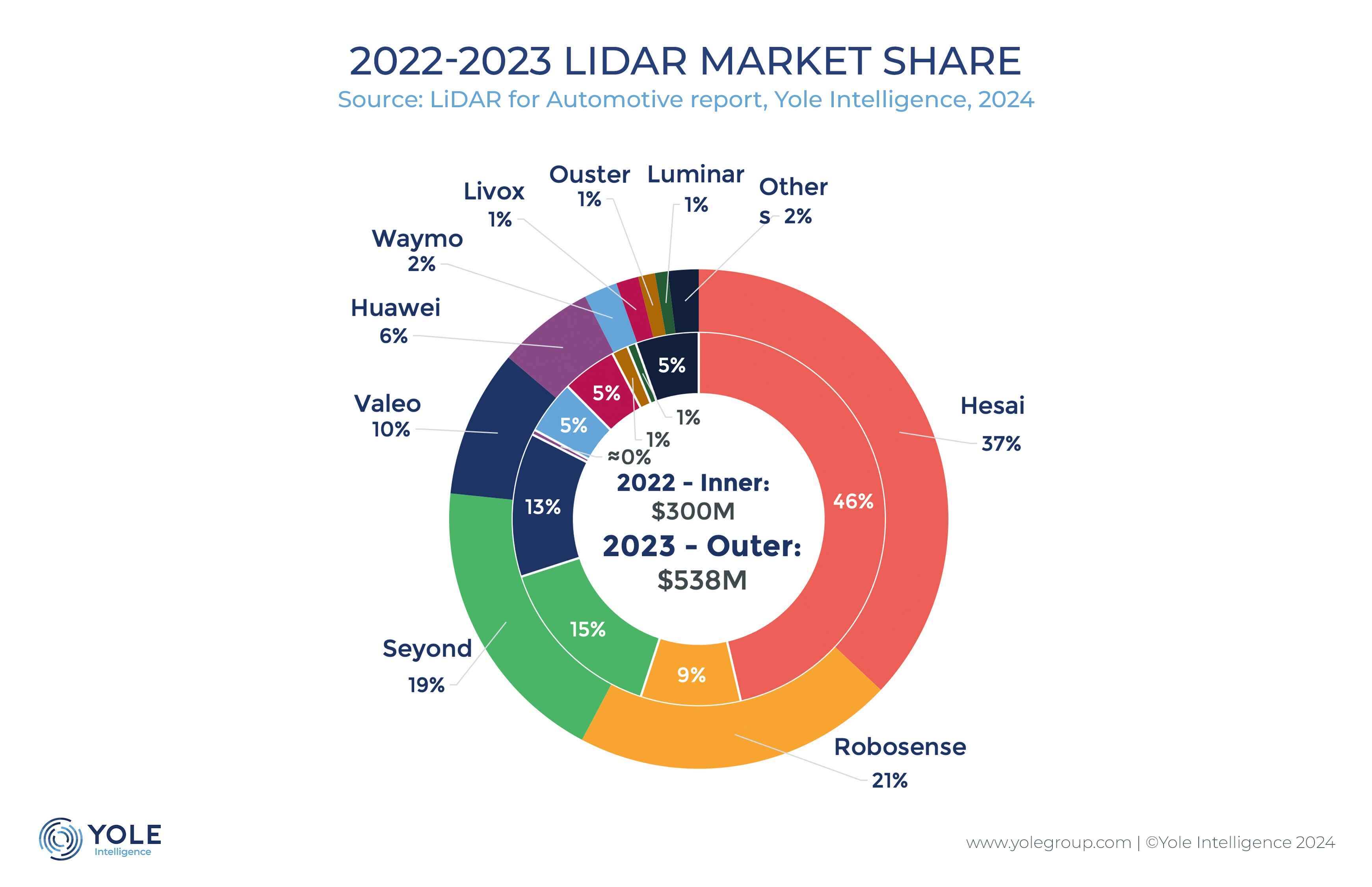

Chinese OEMs are pushing for the integration of LiDAR in their vehicles. In 2024, Hesai and RoboSense are expected to continue leading the passenger car LiDAR market.

LiDAR manufacturers are now producing higher volumes and new technologies, which should reduce the cost of LiDAR.

In 2022, the market was at a crucial junction with significant differences between the PC (Passenger Car) and LCV (Light Commercial Vehicle) segment and the robotaxi segment. By 2023, however, the PC&LCV market had clearly taken the lead.

“The journey of robotaxi services began in August 2016 with NuTonomy’s launch in Singapore,” says Yole’s Pierrick Boulay, “this was followed by a significant milestone in 2017, the entry of Waymo and Cruise in Phoenix, AZ, and San Francisco, CA. Subsequently, Chinese companies such as DiDi, AutoX, and Baidu joined the fray, rolling out services in various cities across the globe. This rapid proliferation of robotaxi services pushed the LiDAR market for robotaxis significantly ahead of that for passenger cars.”

However, in 2023 and 2024, Waymo and Cruise markedly slowed their operations due to a series of incidents, directly impacting the robotaxi market. This slowdown could also affect the long-term market outlook as these companies strive to regain public trust.

In 2023, the robotaxi market was valued at $124 million, while the PC&LCV market stood at $414 million. The passenger car market, more than three times the size of the robotaxi market, is experiencing a substantial take-off.

Yole’s Automotive LiDAR Comparison 2024 report has an overview of the technology choices from 4 leading LiDAR companies, Valeo, RoboSense, Seyond, and Hesai, together with a detailed cost comparison.

Since 2018, nearly 200 design wins have been noted, with 124 scheduled for commercialisation in 2024 or soon thereafter.

Notably, almost 90% of these are from Chinese OEMs, who are aggressively pushing to integrate LiDAR into their vehicles.

Unlike their European and US counterparts, which primarily limit LiDAR to the high-end F segment, Chinese OEMs are incorporating LiDAR into the more affordable D segment.

In 2023, the first LiDAR-equipped car in the C segment was introduced. These vehicles are much more affordable than those in the F segment, leading to higher production volumes of LiDAR-equipped cars and consequently driving significant price reductions for LiDAR technology.

최신 산업 동향을 받아보려면 구독하세요.저희 뉴스레터는 전문가가 제공드리는 가치있는 시장 정보입니다.

The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increa

In 2025, we expect 9.5% growth in the global semiconductor market, driven by robust demand for data centre services, including AI. However, growth in other, more mature segments is expected to be stag

Taiwanese chip manufacturer TSMC has announced a $100 billion investment in the United States, aiming to build five additional semiconductor facilities.The plan was revealed by TSMC CEO C.C. Wei along

Prices of mature process memory, long hit by oversupply due to fast capacity expansion at Chinese makers, are expected to rebound, thanks to the Chinese government's consumption stimulus programs.

With the ongoing development of new-generation processors, the introduction of PCIe Gen5 specifications into high-end PC applications is set to commence in 2025. According to Micron Technology, Gen4 p

The global market is watching how TSMC, pressured by the US, might assist Intel's foundry operations, while Samsung Electronics and Rapidus, also facing challenges, may similarly require TSMC'