According to TrendForce’s latest memory spot price trend report, neither did the DRAM nor NAND spot prices sees much momentum last week. Spot prices of DDR4 and DDR5 products didn’t show significant fluctuations as the market has not seen a demand uptick. As for NAND flash, the wave of stocking demand during July in response with the peak season in the third quarter of each year didn’t appear. Details are as follows:

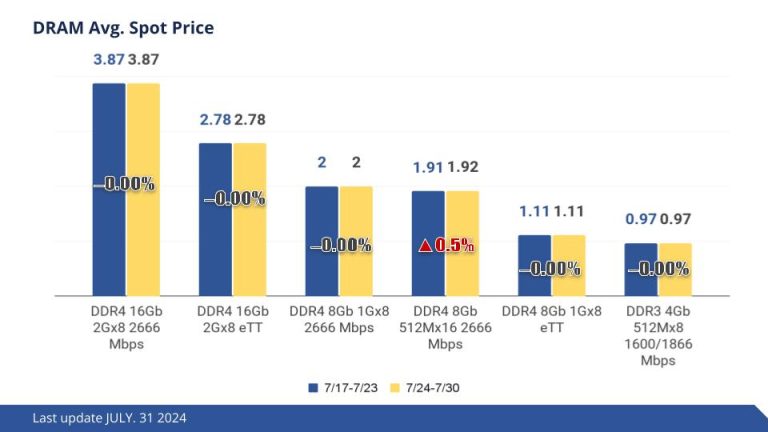

DRAM Spot Price:

In the spot market, the overall trading volume has fallen further because the demand for consumer electronics has yet to rebound, and Taiwan’s spot trading was suspended for two days (from July 24th to 25th) due to a typhoon. The spot market as a whole has not seen a demand uptick compared to the previous week, and buyers are mostly waiting for further developments. Consequently, spot prices of DDR4 and DDR5 products have not shown significant fluctuations. The average spot price of the mainstream chips (i.e., DDR4 1Gx8 2666MT/s) dropped by 0.35% from US$2 last week to US$1.993 this week.

NAND Flash Spot Price:

The spot market would usually generate a wave of stocking demand during July in response with the peak season in the third quarter of each year, but has been rather sluggish this year due to the sufficient extent of inventory among end clients, as well as enervated market demand. A small number of spot traders were attempting to lower their quotations tentatively last week in the hope of revitalizing buyers’ demand, which was proven to be quite ineffective. Generally speaking, recent spot market prices have been somewhat lethargic alongside a continuous shrinkage of transactions. Spot price of 512Gb TLC wafers remains unchanged this week at US$3.253.

최신 산업 동향을 받아보려면 구독하세요.저희 뉴스레터는 전문가가 제공드리는 가치있는 시장 정보입니다.

The US has initiated a Section 301 investigation into China's mature semiconductor processes and third-generation silicon carbide (SiC) semiconductors. Supply chain operators state that the increa

In 2025, we expect 9.5% growth in the global semiconductor market, driven by robust demand for data centre services, including AI. However, growth in other, more mature segments is expected to be stag

Taiwanese chip manufacturer TSMC has announced a $100 billion investment in the United States, aiming to build five additional semiconductor facilities.The plan was revealed by TSMC CEO C.C. Wei along

Prices of mature process memory, long hit by oversupply due to fast capacity expansion at Chinese makers, are expected to rebound, thanks to the Chinese government's consumption stimulus programs.

With the ongoing development of new-generation processors, the introduction of PCIe Gen5 specifications into high-end PC applications is set to commence in 2025. According to Micron Technology, Gen4 p

The global market is watching how TSMC, pressured by the US, might assist Intel's foundry operations, while Samsung Electronics and Rapidus, also facing challenges, may similarly require TSMC'